Simplifying retirement for all. One plan. Every business.

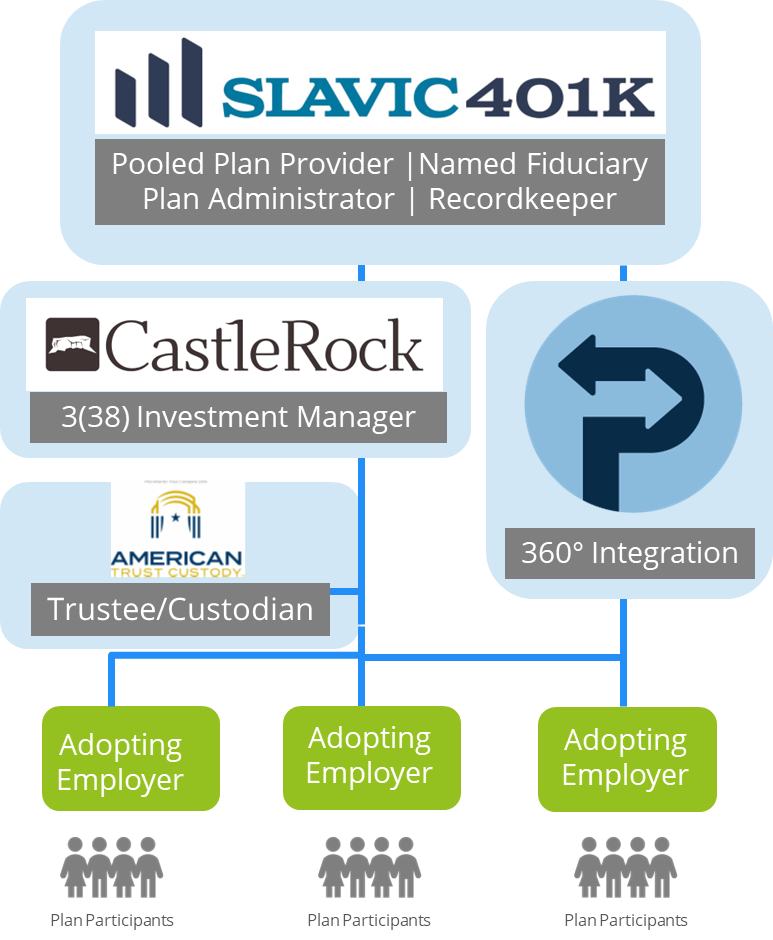

Castle Rock PEP is offered in partnership with Slavic401k. Together, we have created a retirement plan that levels the playing field between enterprise and small business. Castle Rock PEP is where retirement plans co-work smarter, not harder.

Plan Administration

Outsourced

Unlike traditional 401(k) plans that leave employers to manage compliance, audits, and investment oversight alone, Castle Rock PEP pools employers together in one plan, delivering economies of scale, fiduciary protection, and professional plan management.

Imagine If...

We pooled together

Castle Rock PEP was designed with every size employer in mind. This allows businesses to focus on growing their companies while offering employees a secure, compliant, and easy-to-understand path to retirement.

See things in action

See how many choices you have to customize the plan for your business.

With the Castle Rock Pooled Employer Plan (PEP), you can:

-

Scale

Join forces with other businesses

-

Compete

Get access to better investments and services

-

Save Time

Outsource plan administration

-

Support Your Team--and Your Future Self

Select tailored plan provisions to attract and retain your team

-

Save Money

Do you pay for an audit every year? Join Castle Rock PEP and that invoice is paid by Slavic401k

Why Castle Rock PEP is Different

This isn't just a retirement plan. When you join Castle Rock PEP, you get:

- Personalized investment advice

- Free financial planning software

- Community spotlights to promote your business

- Human support--from a firm led by a woman who's been advising workplace retirement plans for over two decades

Innovative Match Approach Increases Participation

Read how our client increased employee participation from 67% to 98% and was selected as a finalist for Plan Sponsor of the Year.

Our values

Transparency. Honesty. Trust. Creative Solutions.

When you work with Castle Rock Investment Company, you can expect:

- No hidden fees: You will always know what you are paying for.

- No commissions: Our advice is unbiased and in your best interest.

- Innovative Solutions: We provide creative and effective retirement solutions tailored to your needs.

As Featured In City Lifestyle

Castle Rock Investment Company was featured in April's issue for managing the retirement investments in the pooled employer plan.